Are you looking to save some extra money this month?

Maybe you have a big purchase coming up or you just want to build up your emergency fund.

Whatever your reason may be, taking on a 30-day money challenge could be just what you need!

By committing to saving a certain amount of money each day for 30 days, you can quickly build up your savings and reach your financial goals.

In this blog post, we’ll explore what a 30-day savings challenge is, how it works, and some tips and tricks to help you successfully complete the challenge. So, let’s get started!

What is a 30 day savings challenge?

A 30-day savings challenge is a financial challenge where you commit to saving a certain amount of money every day for 30 days.

The challenge is designed to help you build the habit of saving money and to help you quickly accumulate savings.

The amount you save each day can vary, depending on your personal financial goals and your current budget.

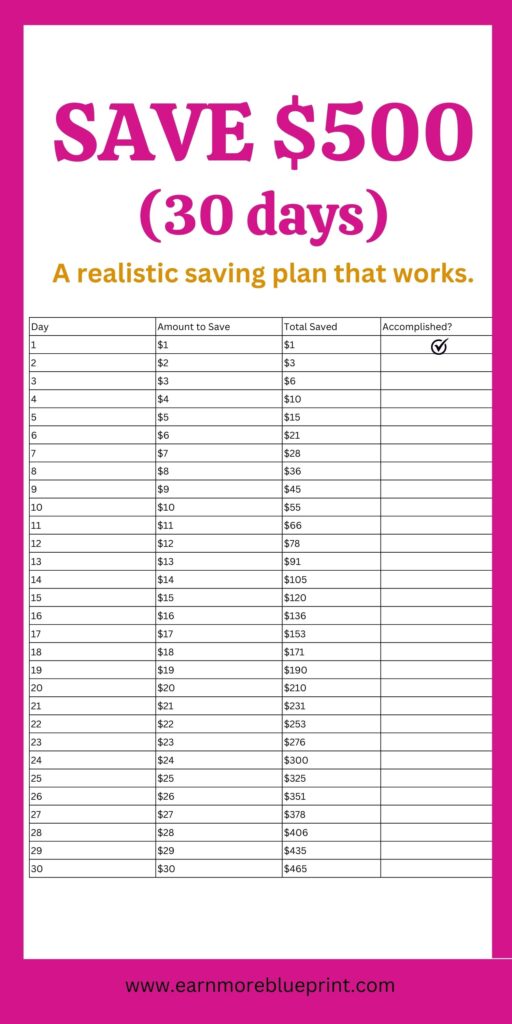

Some popular savings challenges encourage participants to start with a small amount, such as $1 on the first day, and then increase the daily savings amount by $1 each day, so that by the end of the 30-day challenge, they are saving $30 per day.

Other challenges may set a fixed daily savings amount, such as $5 or $10 per day. Regardless of the specific challenge, the key is to commit to saving a consistent amount every day for 30 days, which can help you build momentum and achieve your savings goals.

How this 30 day money challenge works

For this challenge, the goal is to help you save near 500USD (or GBP or EUR) by the end of the month.

The free worksheet shows you how much to be saved in a day for the 30 days.

For accountability, you check off everyday you succeed in putting the specified amount away.

How to save your money during the 30 day challenge

This will vary depending on preference but most importantly on how you get paid.

- Put the amount to be saved in a save money Jar or a cash envelope.

- Create a standing order to transfer the total amount to be saved to another account.

- If a daily standing order is not very practical for you, use the money jar or transfer the amount to be saved to your savings account everyday.

The goal is to encourage your saving habit. So do whatever works and is the easiest, so you don’t lose motivation.

Struggling to see how you can possible save $500 from your current income?

Here are some great ideas.

1. Make fast money this month

- Sell printables – Selling printables is the easiest side hustle to make passive income. You can do it in your own schedule and earn over $10,000 a year selling simple printables.

- Proofreading – Earn $15-20+ an hour proofreading online. Set your own schedule, choose what you want to proofread and when.

- Complete short tasks – Make money filling out surveys or playing games on Swagbucks. You can earn up to $5 per task, tasks take only a few minutes to complete.

2. Get Cashback every time you shop

It’s possible with the Rakuten app.

Rakuten is a free mobile app (iOS and Android) that offers up to 20% cash back when you do your shopping online with favourite brands such as Tesco, M&S, Walmart and more.

Simply shop in the mobile app or add the free browser extension to your computer so you don’t miss out on your cashback or free rewards.

Want to know more about how Rakuten works to give you cashback? Check out this Rakuten explainer video, here!

Sign up for free at Rakuten here

Other cashback apps you’ll enjoy:

- Quidco

- TopCashback

3. Use Meal prepping to save at least $100 a month

Meal prepping will save you time and money.

It’s simply about planning what you will eat for a week in advance.

By doing this, you avoid multiple trips to the grocery store.

You also avoid last minute spending on take away meals.

If you don’t know where to start, I recommend using this £3.00 meal plan service (and get a Free 7-Day Trial when you sign up here!). For only £3.00 a month, you get a weekly meal plan.

Your meal plan will include healthy meal-prep recipes + a shopping list, with every meal designed to cost no more than £2/person!

Still thinking about it? You can have this free meal plan while you make up your mind.

4. Cut down the number of times you eat out.

Imagine you have pizza night (~£40) every Friday night, 4 times a month (Total: £160).

Then you also have Chinese take outs (~£30) every Sunday night (Total: £120).

Then…you also buy your work lunch (£6 x 20 working days)= £120.

You will be spending £400 on only take outs which adds up to £4,800 per year.

Save this money for other things by cooking most of your meals at home. It’s also healthier since you have control over what goes into the food.

Not sure what recipes to cook at home? Check Pinterest for ideas, try the £3.00 Meal Plan for Free for 7 days. I also highly recommend the $5 meal plan which is for free for 14 days. You won’t regret it.

5. Get 15% off when you subscribe to monthly delivery of must-have items.

Do you buy pasta, rice, coffee, dishwashing liquid, canned beans etc. every month??

Do you know you can get them delivered straight to your home for 15% off!! if you sign up for an Amazon Prime Account (if you don’t have an account, get a free 30-Day trial here).

This will save you £100’s every month! It’s a really easy hack to save more money that people don’t talk about.

Related articles

25 ways to spend less than you earn

How to start a 6 figure business selling digital products

20 proofreading jobs to earn up to $60,000

20 Virtual assistant jobs to start today

10 side hustles you can start using Canva

The best remote jobs to replace your full-time income.

We hope this list gives you some inspiration to make more money and save more every month.

Let us know if you have any comments.

Don’t forget to share and follow us on pinterest.

Thanks for stopping by!